Are you a State Bank of India account holder and looking for knowledge related to SBI Online or the internet banking of SBI? If yes then you have landed on the right page here. Here you will find everything you need to know about the SBI Net Banking. I have explained the things right from logging in into your SBI Net Banking account to registering for the e-Statements.

This is an ever-growing page here on Bank With Us. So before you can check out the step by step procedures to do various things. Let me tell you in brief about the State Bank of India.

About State Bank of India

| Head Office | Mumbai |

| Formerly Known As | Imperial Bank of India |

| Trade As | NSE: SBIN

BSE: 500112 LSE: SBID BSE SENSEX Constituent CNX Nifty Constituent |

| ISIN | INE062A01020 |

| Founded On | 1st July 1955 |

| Type of Bank | Public Sector Bank |

| Chairman (Jan 2020) | Ranjnish Kumar |

| Products | Investment Banking, Consumer Banking, Commercial Banking, Retail Banking, Private Banking, Asset Management, Pensions, Mortgages, Credit Cards |

| Owner | Government of India |

| Number of Employees | 257,252 (March 2019) |

| Owner of the Bank | Government of India |

| Website | sbi.co.in |

| Revenue (2019) | ₹2.79644 trillion |

| Operating Income (2019) | ₹554.36 billion |

| Net Income (2019) | ₹8.62 billion |

| Total Assets (2019) | ₹36.80914 trillion |

| Customer Care (toll-free) | 1800 425 3800 |

How to Login to SBI Net Banking?

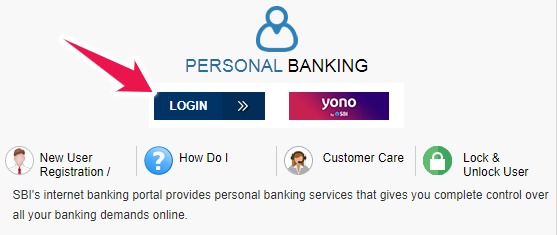

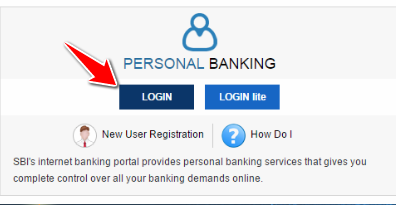

Once you have got yourself registered to the SBI Net Banking you can login and start using the SBI Online services for your bank account. The process to login to SBI Net Banking is as mentioned below.

- First, the bank account holder must visit the official website of SBI.

- Click on Login under the personal banking on the official website.

- You will be taken to the personal banking page click on Continue to Login button.

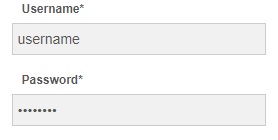

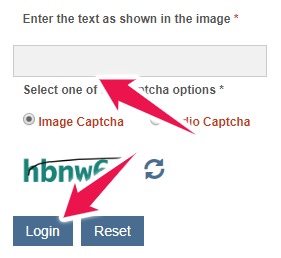

- Enter your Username and Password.

- Solve the ReCaptcha and click on Login Button.

- Keep your computer free of malware.

- Change your passwords periodically

- You should never respond to any communication seeking your passwords.

- Never reveal your passwords or card details to anyone.

- The bank will never call you asking your OTP, Username, Password, ATM PIN Number, etc.

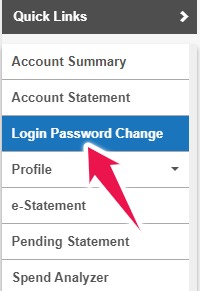

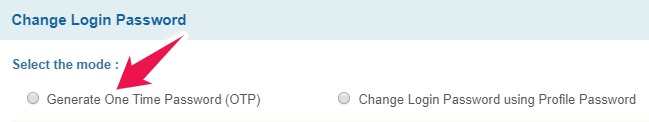

How to Change Login Password in SBI Internet Banking?

I have also mentioned in the things which you should remember while using the internet banking services that you should periodically change the passwords. So let us check out how you can change the Login password of your SBI internet banking.

- Visit the official website of the State Bank of India.

- Click on the Login button under the Personal Banking section.

- Enter your username, password, solve the ReCaptcha and click on the login button.

- Click on Login Password Change from the left sidebar of the internet banking interface.

- Click on Generate One Time Password. (OTP)

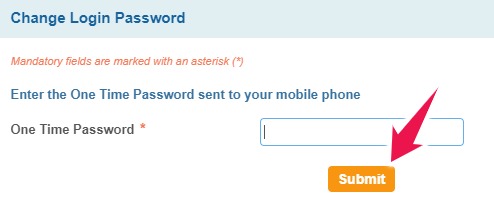

- Enter the OTP you received on your registered mobile number and click on Submit.

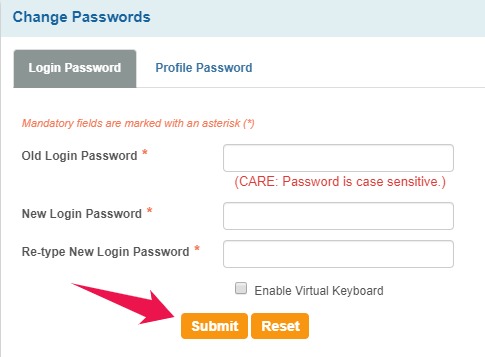

- Enter your old login password.

- Now Enter the new password you want to use.

- Re-enter the same password for confirmation and click on Submit.

- The profile password should not match the login password.

- Password length should not be less than 8 and not more than 20 characters.

- The password should contain at least one digit [0-9], one alphabet [A-Z] [a-z] and one special character such as [@#&*!].

- Please avoid choosing a password that is generic in nature, guessable or inferable.

- Avoid password that is related to your personal data such as name, date of birth, address, telephone number, and car or bike registration number.

- It is a good practice to memorize your password rather than write it down somewhere.

- For security reasons, keep changing your password at regular intervals.

How to Change Profile Password in SBI Online Net Banking?

The login password is not the only password that is used to ensure the security in SBI Online. We also have something called Profile Password. This password is used when we try to make changes to the profile of our State Bank of India internet banking.

When we try to change our Email address, change the usage rights, etc. the profile password is used. And you should not get confused between the login password and the profile password these are two different things and not the same. The process that you need to follow to change profile password in SBI Online is as mentioned below.

- Visit the official website of the State Bank of India.

- Click on the Login button under the Personal Banking section.

- Enter your username, password, solve the ReCaptcha and click on the login button.

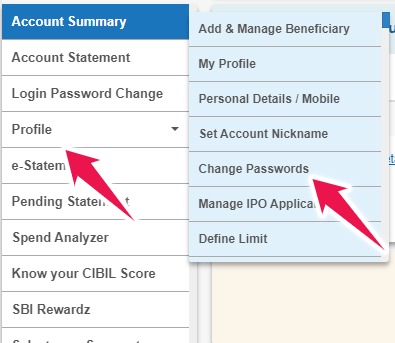

- Click on Profile in the left sidebar and then on Change Passwords.

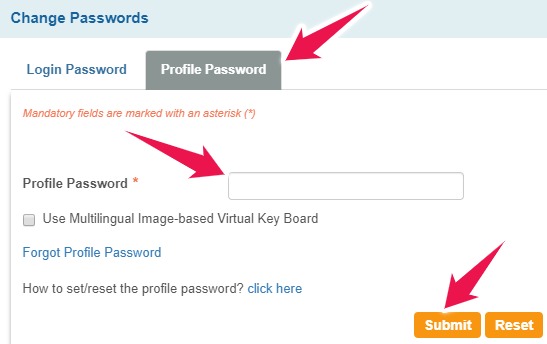

- Click on Profile Password, enter the current profile password and click on Submit.

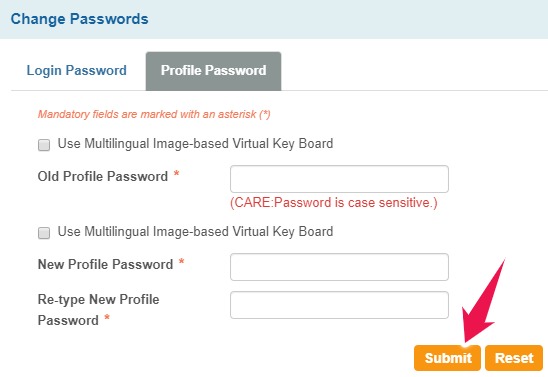

- Enter the old profile password again.

- Enter the new password you wish to have as your Profile Password.

- Re-enter the profile password and click on Submit.

- If Profile is locked due to 3 consecutive wrong attempts, hint questions link will not be available to the user for the day.

- Users can raise a request to any branch to reset the profile password with a registration form containing a reference number.

- The profile password should be different from the login password.

- Avoid password that is related to your personal data such as name, date of birth, address, telephone number, and car or bike registration number.

- Password length should not be less than 8 and more than 20, it should contain at least one alphabet, one numeric character, and one special character.

- In case the customer uses the Multi-Image Virtual Key Board (MIVKB), the password should contain at least one alphabet, one numeric character, and two images.

- It is a good practice to memorize your password rather than write it down somewhere.

- For security reasons, keep changing your password at regular intervals.

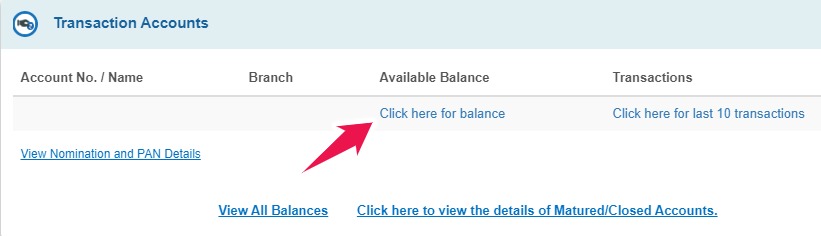

How to Check Balance via SBI Net Banking?

Once you have successfully logged in into your SBI Internet Banking account, you are allowed to check the balance that is remaining in your bank account. The process which you have to follow to check balance of your bank account Using SBI Internet Banking is mentioned below.

- Visit the official website of the State Bank of India.

- Click on the Login button under the Personal Banking section.

- Enter your username, password, solve the ReCaptcha and click on the login button.

- Click on “Click here for balance” link just beside your bank account to view your bank balance.

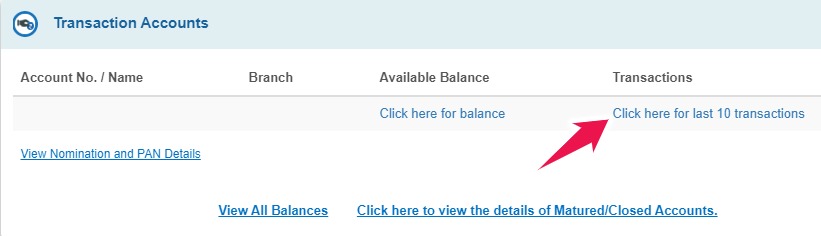

How to Check the Last 10 Transactions in SBI Internet Banking?

You can not only check the balance using the internet banking feature of the State Bank of India. There is also an option in SBI online using which you can check the last 10 transactions. The process which you need to follow to check the last 10 transactions is mentioned below.

- Visit the official website of the State Bank of India.

- Click on the Login button under the Personal Banking section.

- Enter your username, password, solve the ReCaptcha and click on the login button.

- Click on “Click here for last 10 transactions” link to get the details of the last 10 transactions.

How to Add Beneficiary in SBI Internet Banking?

Internet banking feature is widely used to make online funds transfers. But if you wish to make online funds transfers from your State Bank of India account. Then you have to add beneficiary in SBI Internet Banking. If you don’t know about it then there is no need to worry. Because the process to add beneficiary in SBI Internet Banking is mentioned below.

- Visit the official website of SBI: https://www.onlinesbi.com/

- Enter your username and password to login to your internet banking account.

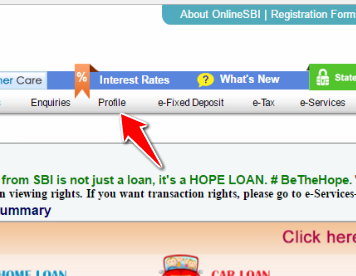

- Once you login to your internet banking account you have to select the Profile option which you can find on the upper menu of the website.

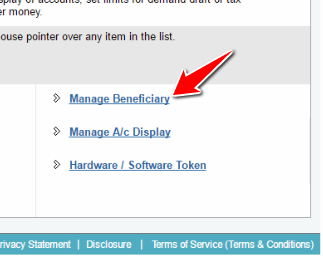

- You will see all the profile related options on your screen. From there click on Manage Beneficiary option.

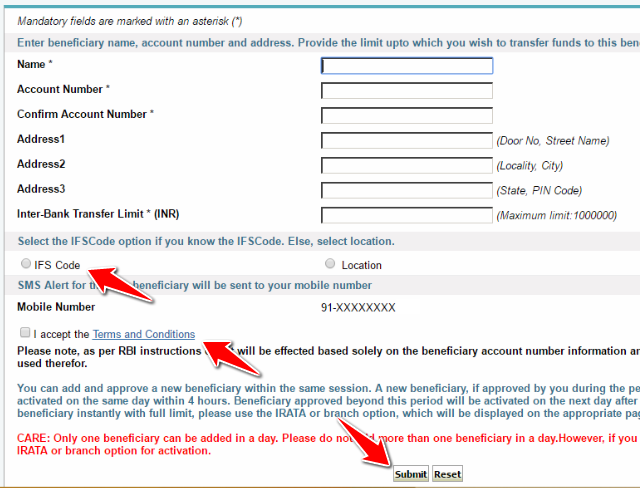

- When you click on Manage Beneficiary option from the profile page you have to enter your Profile password.

- From the next page select what kind of beneficiary account you want to add to your internet banking account. I have already mentioned the two types of beneficiary account at the beginning of this guide.

- Enter details of the beneficiary account which you want to add. Details like account holders name, account number, etc.

- Read the terms and conditions by following the link provided on the page.

- Once you enter all the details click on the Submit button which you can find at the bottom part of the page.

Tip: If you want to know the steps to delete beneficiary in SBI Online, then you can read them here by following this link.

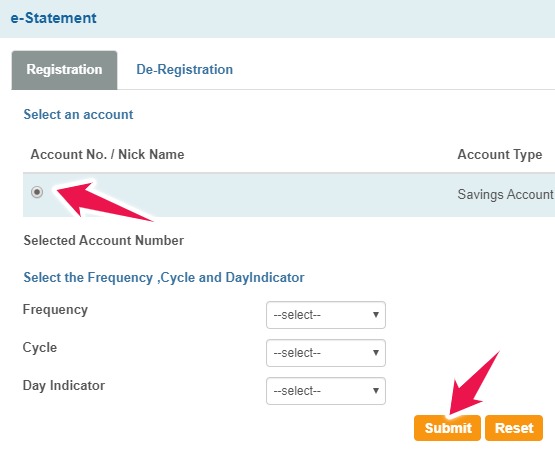

How to Register for e-Statement in SBI Net Banking?

If you want to receive the bank account statement via email then you can get it directly in your inbox. To get this you have to register for e-Statement in SBI Online. If you want to opt-in for these e-Statements then the process is mentioned below.

- Visit the official website of the State Bank of India.

- Click on the Login button under the Personal Banking section.

- Enter your username, password, solve the ReCaptcha and click on the login button.

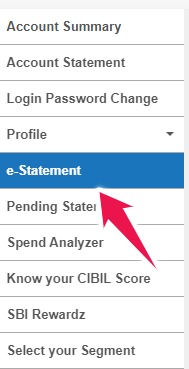

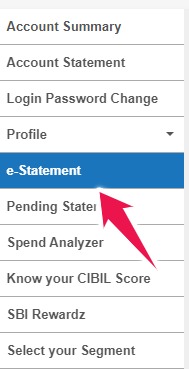

- Click on e-Statement which can be found in the left sidebar of the net banking interface.

- Select the bank account of which you would like to receive the e-Statements.

- Choose the frequency, cycle and the day indicator of the statements and click on submit.

- Statement will be sent to your registered Email ID.

- The cycle is the month from which the e-Statement will be sent.

- Day Indicator is the date of the month on which e-Statement will be sent. For example, if you have selected frequency “Q” i.e. Quarterly with Cycle and Day Indicator selected as 6 and 10, the first e-Statement will be sent on the 10th Day of June. The next statement will be sent on the 10th Day of September and likewise.

- The statement will not be generated if there are no transactions performed during the selected cycle.

- In the case of a Joint account, the primary account holder will be eligible for the e-Statement facility. If you are a secondary account holder, you will not receive e-Statement.

How to De-register e-Statements in SBI Net Banking?

People don’t de-register from this service, but if you are willing not the receive the e-Statements from the State Bank of India via Email. Then you can de-register the same. The steps which you need to follow are as mentioned below.

- Visit the official website of the State Bank of India.

- Click on the Login button under the Personal Banking section.

- Enter your username, password, solve the ReCaptcha and click on the login button.

- Click on e-Statement which can be found in the left sidebar of the net banking interface.

- Click on the de-register button.

- Select the bank account which you want to de-register from this service and click on the Submit button.

SBI Online Transaction Limits and Charges

Internet banking can help you to make online transactions seamlessly. But you should also note that there are some limits imposed on the online transactions that you can make with the help of internet banking. We have mentioned the limits of the transactions below.

| Type of Transaction | Limit Per Day | Charges for Transactions |

| Transfer within Self Accounts (SBI) | Rs. 2,00,00,000 | No Charges |

| Interbank Funds Transfers – NEFT | Rs. 10,00,000 | No Charges |

| Recurring Deposits | Rs. 99,99,999 | No Charges |

| Fixed Deposits | Rs. 99,99,999 | No Charges |

| Interbank Funds Transfers – RTGS | Rs. 10,00,000 | No Charges |

| Third Pary Transfers within SBI | Rs. 10,00,000 | No Charges |

| IMPS Funds Transfer | Rs. 2,00,000 (per transaction) | No Charges |

| Quick Transfer | Rs. 25,000 | No Charges |

| SBI mCash | Rs. 2,202 | Rs. 2.50 + tax per transaction |

| VISA Credit Card Transfer | Rs. 1,00,000 | Rs. 15 + tax per transaction |

| UPI Funds Transfer | Rs. 1,00,000 | No Charges |

| Merchant and Bill Payments | Rs. 1,00,000 | No Charges |

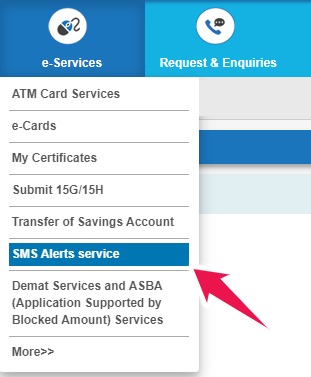

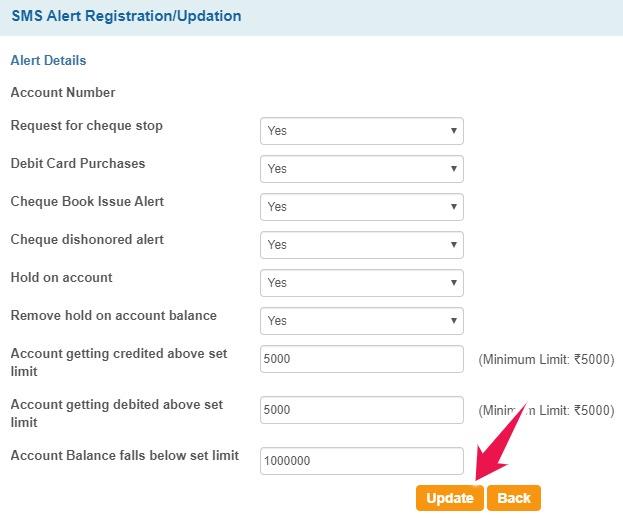

How to Activate or Deactivate SMS Alerts in SBI Online?

Usually whenever any kind of transaction takes place in our bank account. The bank will be sending us an SMS on the registered mobile number regarding the transaction. May it be the debit card transaction or internet banking transactions. But in case you want to update the norms of the SMS alerts for your bank account, then you can do that online. The step by step instructions to activate or deactivate SMS alerts in SBI online is mentioned below.

- Visit the official website of the State Bank of India.

- Click on the Login button under the Personal Banking section.

- Enter your username, password, solve the ReCaptcha and click on the login button.

- Click on e-services which can be found on the top menu of the internet banking interface.

- You will get a drop-down menu click on SMS alerts Service from that menu.

- Select the bank account for which you want to update the SMS alerts. (in case of multiple accounts)

- Toggle between yes or no for various options as per your choice and click on Update.

- Update your mobile number through the branch or Online mode under the Profile section.

- SMS alerts are a smart way to monitor the transactions happening in your account(s).

- SMS is triggered when your account is credited/debited for an amount above the credit /debit threshold.

- SMS is also triggered whenever the balance falls below the threshold limit.

- ‘Hold on an account’ is when a lien is marked in your account due to failure of loan repayment, statutory notice served on the account etc.

What is SBI Online?

SBI Online is the official website of the State Bank of India. With the help of this website, you can use the internet banking feature of the bank. You can use Online SBI to check your balance, do funds transfer and more.

Are there any charges to use SBI Online?

There are no charges to access SBI Online. But you can be charged by the bank for the different services you use. For example, there will be charges for IMPS, NEFT and RTGS funds transfer. There is also a charge for getting your CBIL Score Report. When you use such services you will be charged by the bank.

How can I check my SBI bank balance online?

You can check your bank account balance online by logging in into your SBI Online account and click on Click here to view Balance link.

How can I use SBI net banking on mobile?

You can use SBI Net banking on Mobile simply by using the Chrome Browser. But it is not recommended to use it that way. It is suggested to install the YONO SBI application on your smartphone to use internet banking services on mobile.

What is the official website of State Bank of India?

The official website of State Bank of India is: https://www.onlinesbi.com/

What is profile password in SBI?

Profile Password is the one that is used when you are trying to access and make changes to your bank account's profile using internet banking services. For example, you will be asked to enter the profile password if you want to add any beneficiary accounts and make changes to your Email ID, etc.

What is Login Password in SBI?

The login password is the one that is used to login to your internet banking account. You will be asked to enter your login password along with your username when you try to access your bank account online on the official website of SBI.

How do I check my bank account balance on my phone?

If you want to check your bank account balance on your phone, then you can do that by using the YONO SBI application. All you need to do is install this application on your phone. And enter your internet banking username and password to access your bank account on your smartphone.

Is customer ID same as CIF?

No, customer ID and the CIF number is not the same. Customer ID is different whereas the CIF number is customer information file number.

How can I activate YONO in SBI?

There is no need to activate the YONO SBI application if you have activated internet banking for your account. All you have to do is install the YONO SBI application and enter the same username and password which you use for internet banking services.

How many attempts are there in SBI online login?

You will have 3 chances to enter the correct password. If you enter the wrong password 3 times then your account will be locked.

Is CIF number and IFSC code same?

No, CIF Number and IFSC Code Number is not one and the same. CIF Number is Customer Information File Number whereas IFSC Code is the Indian Financial System Code.

Can I get CIF number through SMS?

No, you can not get your CIF number through SMS. You can get your State Bank of India CIF number on the first page of your Bank Passbook.

Can I have 2 accounts in SBI?

Yes, you can have multiple bank account in different branches of State Bank of India.

What is the SBI minimum balance?

There are different types of bank accounts available in State Bank of India and every type of account has a different balance which you have to maintain. To get the most accurate details about the minimum balance it is recommended to contact the bank itself.

Is SBI a Government Bank?

Yes, State Bank of India is a Government bank that is owned by the Government of India. SBI is the biggest bank which is currently operating in India.

What is the Full Form of SBI?

SBI stands for State Bank of India.

Can I Deposit Money into a Frozen SBI Account?

Yes, you can deposit money into the bank account of SBI which is currently Frozen. But you are not permitted to withdraw the money from your frozen bank account until the freeze is taken away from your bank account.

How Many Savings Account Can an Individual Hold in SBI?

An individual can hold a maximum of 2 savings bank account in State Bank of India.

What happens if SBI account balance is zero?

If your bank account is not a Zero Balance account. Then the bank will charge you for the non-maintenance of the monthly average balance in your bank account.

Is it safe to use YONO SBI?

Yes, the YONO SBI App is completely safe and you can use it without any hesitations as it is an official application launched by the State Bank of India.

Can I Block my Debit Card using SBI Net Banking?

Yes, you can block your lost ATM Card or Debit Card using the Net Banking of State Bank of India.

How can I know my SBI account balance is negative?

To know if your SBI account balance is negative you have to log in to your internet banking account and click on View Balance.

Can we withdraw minimum balance from SBI?

Yes, you can withdraw but it is not recommended as the bank might charge you for not maintaining your minimum balance in your bank account.

Can I Apply for New Debit Card using SBI Internet Banking?

Yes, you can apply for a new debit card or ATM card for your bank account using the internet banking feature of the bank.

Can I Get Bank Account Statement using SBI Online?

Yes, you can view and also download the bank account statements of your Savings, Current and Loan accounts using the SBI Online Net Banking services.

Can I use YONO without internet banking?

Yes, you can use the YONO SBI application without internet banking as well. But for that, you have to register for YONO using your ATM Card details.

What happens if we don't maintain minimum balance in SBI?

If you don't maintain the minimum balance in the SBI account then the bank will charge you for not maintaining the minimum balance.

Can I Apply for Credit Card using SBI Online?

Yes, you can apply for SBI Credit Card using internet banking services. The system will redirect you to the SBI Cards website from where you can apply for the credit card.

Can I Pay Credit Card Bill Using SBI Online?

Yes, you can pay your credit card bills using the internet banking services of the State Bank of India.

How to Pay Credit Card Bill using SBI Net Banking?

You can pay your credit card bill by adding your credit card as a beneficiary in your internet banking account.

Can I add Beneficiary in YONO SBI?

Yes, you can add beneficiaries using the YONO SBI application.

Can I open SBI bank account online?

Yes, you can open the SBI Bank account online by visiting the official website of the bank.

How can I check my SBI account balance by SMS?

You can check your bank account balance by SMS. But for that, you will have to register for SMS banking of the State Bank of India.

Can I request Cheque Book using SBI Internet Banking?

Yes, you can request cheque book for your SBI account using internet banking services.

Can I Register or Update Email Address using SBI Net Banking?

Yes, you can register as well as update your email address online using the SBI Internet Banking services.

Can I link PAN Card Details using the SBI Internet Banking?

Yes, you can update or link your PAN card details in your bank account using the internet banking services of the bank.

Can I Link Aadhaar Card with SBI Account using Internet Banking?

Yes, you can link your aadhaar card using internet banking services.

Can I Register for e-Statements using Internet Banking?

Yes, you can start receiving your bank account statements via email by registering for e-Statements using the Net Banking of SBI.

Can I De-Register for e-Statements?

Yes, if you wish to stop receiving your e-Statements then you can de-register by using internet banking.

Can I delete beneficiary account online in Net Banking?

Yes, you can delete the beneficiary account in SBI Internet Banking account,

Can I Change SBI Login Password Online?

Yes, you can change SBI Net Banking Login Password Online using Internet Banking services.

Can I Change SBI Profile Password Online?

Yes, the profile password of the State Bank of India Internet Banking can be changed online using internet banking.

Can I Download Bank Account Statement Online?

Yes, you can download the bank account statement online using internet banking services.

Is SBI Mobile Banking and Internet Banking Same?

No, mobile banking and internet banking are totally different. Mobile banking helps you to access your bank account online on smartphones. Whereas the internet banking is used to access your bank account online using a desktop or laptop computer.

How can I activate my SBI net banking?

You can activate SBI Net Banking Online by visiting the official website of the bank. And if you wish to activate net banking offline then you can do that by visiting your home branch.

How can I activate my SBI User ID?

You can activate your SBI User ID by visiting the official website of the State Bank of India.

How can I reset my Internet Banking Password?

If you want to reset the internet banking password then you can do that by clicking on the Forgot Password link on the official website of State Bank of India.

What is a Internet Banking user ID?

User Id or the Username of the Internet Banking is a unique word used when you try to login to your internet banking account.

Can I Open Fixed Deposit in SBI Online?

Yes, you can open the fixed deposit account with the help of the Internet Banking account of the State Bank of India.

Can I use SBI Online to Close Fixed Deposit Account

Yes, there is an option in SBI Net Banking to Close Fixed Deposit accounts.

Can I Open Recurring Deposit Account Online?

Yes, you can open a recurring deposit account using the SBI Net Banking services.

Can I Close Recurring Deposit Account in SBI Online?

Yes, you can close your RD accounts with the help of the SBI internet banking account.

Can I Transfer Money without Adding Beneficiary in SBI?

Yes, you can transfer money without adding the beneficiary account using the quick transfer option of SBI Online.

Can I View Nomination Details Online in SBI?

Yes, you can view the nomination details for your bank account using the internet banking of the SBI.

Can I Update Nomination Details Online in SBI?

Yes, you can update the nomination details online for your State Bank of India account.