When we talk about the interest rates fixed deposits can easily beat all the savings bank account schemes. If you compare the interest rates that you get in fixed deposits with that of the savings bank accounts of all the top banks in India. Then you will find them good for investment. The risk involved in this investment instrument is all most zero. You can totally rely on this you won’t be losing the money which you have invested in a fixed deposit instrument. In this article of mine, I will be telling you all the details and the steps which you need to follow to open fixed deposit in Canara Bank.

Canara Bank is one of the public sector banks which is owned by the government of India. It is not only one of the biggest ones. But also one of the oldest public sector banks which are operating in India. They are trustworthy and you don’t need to worry about the safety and security of the money you have invested in your fixed deposit. When it comes to open fixed deposit in Canara Bank. There are multiple methods that you can use to perform this task.

In this article, you will find everything you need to know about FD’s and the process to open an FD in this bank. I will be trying to tell you everything which you should know in this article. So I strongly suggest you read the full article to understand the things. It is important to make sure that you don’t miss out on any of the aspects related to open fixed deposit in Canara Bank. The interest rates offered by the banks are quite different, you don’t find the interest rates at PAR with other banks.

There is a huge competition between the banks in terms of the Fixed Deposit Interest Rates as well. There are some banks that are into the business for a long period of time but the interest rates they offer are pretty low. On the other hand, there are some of the new banks which are offering a higher rate of interest both on fixed deposits and savings bank account. Sometimes we feel that it’s better to open a savings bank account that offers a higher rate of interest. That is all because the higher rate of interest which we get with fixed deposits come with a catch.

I will explain to you about the catch or the problems with FD. But before that let us try to gather some more information about the Canara Bank. It becomes important for us to know more details about the bank where we are planning to deposit our hard-earned money. Do you remember that I had told you that the Canara Bank is one of the oldest banks in India?

Yes, you heard it right this bank was founded in the year 1906 in Mangalore, Karnataka. During a period of time Canara Bank was merged with other financial institutions which gave them access to hundreds of branches across India. Other details of the bank are as mentioned below.

About Canara Bank

| Head Office Address | 112 J C Road, Town Hall Junction, Bengaluru, Karnataka |

| Trade As | BSE: 532483 NSE: CANBK |

| Type of Bank | Public Sector Bank |

| Founded | 1906 at Mangalore, Karnataka |

What is Canara Bank Fixed Deposit?

Fixed deposits are one of the banking services which are provided by the Canara Bank which acts as an investment instrument for the customers or bank account holders. The account holders can invest their money in this deposit and earn a higher rate of interest when we compare it to the rates which we get in the Canara Bank savings bank account.

The customers or the bank account holders have to invest their money in this instrument for a fixed period of tenure. And they won’t be able to invest more money or withdraw the money from their fixed deposit account.

Once the FD is matured the money invested in FD will be deposited bank to the bank account of the customer. Or it will be auto-renewed the bank. It depends upon the choice of the customer who is investing money in the fixed deposit.

What is the Problem with Fixed Deposits?

When you open fixed deposit in Canara Bank or any other bank or financial institution you have to choose the tenure or time period for which you wish to invest the money. Once you successfully open the FD then your money will be locked for the tenure of the FD.

This means you won’t be able to withdraw your money from the FD even in case of an emergency. This is the biggest drawback of the fixed deposit. And the next thing is if you wish to invest more in the same fixed deposit you can not do that. You can open a new one but you can not invest more money in the existing one.

If you wish to invest in a systematic manner then you should go with the recurring deposits which will allow you to invest every month in them. In other words, I can say that fixed deposits are not a good option if you are planning for a SIP or Systematic Investment Plan. If you are planning for a SIP then you can choose any liquid mutual fund or recurring deposit.

Solution for this Problem:

When we talk about the problem we should also discuss about the solution to the problem. There is an option for partial withdraw from your fixed deposit account in Canara Bank. And you can even get overdraft or loan up to 90% of the amount you have invested.

Important Factors of Canara Bank Fixed Deposit

There are some very important factors that have an effect on the Canara Bank Fixed Deposit Interest Rates. I feel you should know the factors which have an effect on your investment. I have mentioned them below.

- Polices framed by the Reserve Bank of India.

- Recession.

- Inflation.

- And the current state of the economy.

Who is Eligible to Open FD?

Almost everyone is eligible to open FD in Canara Bank and they are,

- Individuals.

- Partnership Firms.

- Minors.

- Trusts.

- Blind persons.

- Illiterate persons.

- Joint Hindu families.

- Limited companies and partnership firms.

- Municipalities and panchayats.

- Charitable, religious, and educational institutions.

- Associations, societies, clubs, etc.

- Sole proprietary concern.

Identity Proof Documents Required

If you want to open fixed deposit in Canara Bank then you will have to provide the bank some identity proof documents and they are mandatory. The documents which are accepted for proving your identity are as mentioned below.

- Passport.

- Aadhaar card.

- PAN card.

- Voter ID card.

- Driving license.

- Government ID card.

- Photo ration card.

Address Proof Documents Required

Just like the identity proof documents you will also have to provide the address proof documents. The documents which are accepted as mentioned below.

- Passport.

- Telephone bill.

- Electricity bill.

- Bank Statement with Cheque.

- Certificate/ ID card issued by the Post office.

FD in Canara Bank – Premature Withdrawal

If you wish to close the term deposit or the fixed deposit in Canara Bank then you will have to pay the penalty to the bank. The penalty is 1% of the amount which you have invested when it is less than 1 core rupees. I recommend you to contact the bank before you decide to open fixed deposit in Canara Bank. Because it is very important that you should know the penalty that is applicable in the case of premature withdrawal.

Loan against Fixed Deposit Canara Bank

When you open fixed deposit in Canara Bank and after opening, if you are in need of money but you don’t want to break or close the fixed deposit. Then you can still get the money from the bank and that is in the form of a loan.

Canara Bank will give you a loan of up to 90% of the deposit amount at the rate of 5.5% to 7.4%. But you should not that the Canara Bank will not give you a loan against the fixed deposits which you have in other banks. If you need a loan against FD then you should be having the FD in Canara Bank itself.

How to Open Fixed Deposit in Canara Bank?

Now we know enough things about FD and the details of Canara Bank and what actually the bank offers in terms of the FD’s. So now let us check out the steps which you need to follow to open an FD in Canara Bank. You can open it by following two methods and they are as mentioned below.

The first method is online in which we can open FD with the help of the internet banking function of the bank. And the second method is an offline one in which we can open the FD by visiting the home branch of your bank. I will be discussing both the methods with you in this article.

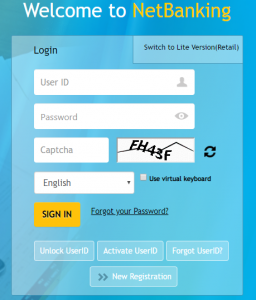

- Go to the official website of the Canara Bank.

- Click on Net Banking Retail/Corporate.

- Enter your User ID and Password of internet banking.

- Solve the Captcha and click on login.

- Click on Deposits from the top menu in the internet banking interface.

- Click on Deposits and then on Open Fixed Deposit link.

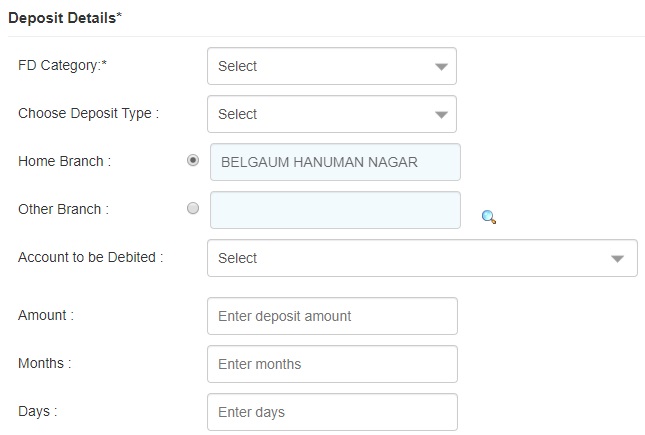

- Choose FD Category.

- Choose Deposit Type.

- Select the account to be debited from the drop-down menu.

- Enter the Amount of Deposit.

- Enter the tenure of your fixed deposit.

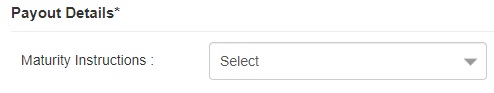

- Give the maturity instructions for your FD, select it from the drop-down menu.

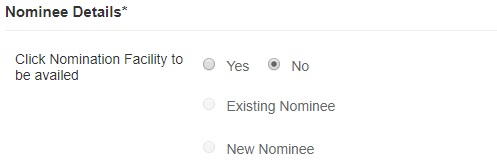

- Enter the nominee details.

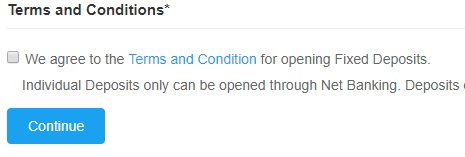

- Read the terms and conditions of the bank and click on Continue.

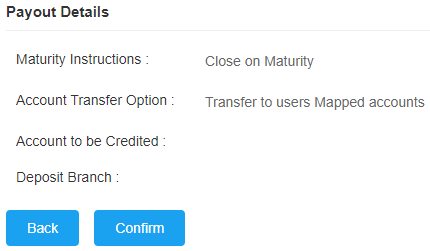

- All the details of your fixed deposit will be displayed on the screen, verify the things and click on the Confirm button.

- Enter your internet banking transaction password and follow the on-screen instructions.

If you don’t want to open fixed deposit in Canara Bank by using internet banking online. Then you can open the FD offline by visiting your home branch. The offline procedure is mentioned below.

- Go to your Canara Bank home branch.

- Tell the bank officials that you want to open an FD.

- Ask them the interest rates they are offering.

- Ask them the different tenures which are available.

- Take a Fixed Deposit Opening Application Form.

- Fill the form with correct details including the FD amount.

- Check the details and submit the fixed deposit opening application form.

Is Canara Bank Safe for Fixed Deposits?

Yes, Canara Bank is totally safe for opening fixed deposits. It is one of the oldest public sector banks which is operating in India and the major thing is this bank is owned by the Government of India. So there is no need to think about the safety and security of the money you invest in the fixed deposits.

Can I Open Canara Bank Fixed Deposit Online?

Yes, you can open fixed deposit in Canara Bank online with the help of internet banking. But to do it you need to have an active internet banking account functionality.

Can I Open Canara Bank Fixed Deposit Offline?

Yes, you can open Canara Bank fixed deposit offline by visiting your home branch. If you don't know how to use internet banking properly then it is recommended to open the fixed deposit offline by visiting your home branch. The bank officials working at your home branch will be happy to help you out with this,

Who is Eligible to Avail Internet Banking?

All the bank account holders of Canara Bank are eligible to use the internet banking feature. All you have to do is go to the official website of the bank and activate internet banking for your Canara Bank Account.

Is it Possible to Open an FD in Canara Bank Offline?

Yes, you can open an FD in Canara Bank Offline by visiting your home branch.

Does Canara Bank Levy any fee for Opening an FD?

No, Canara Bank will levy or charge nothing for opening an Fixed Deposit. It is totally free of cost services. But you should have a sufficient amount of balance in your bank account so that it can be debited for opening the FD.

What are the Mandatory Documents that the Customer has to provide while Opening an FD with Canara Bank?

You will have to provide PAN Card, Aadhaar Card to the bank to open an FD with Canara Bank.

Is it Mandatory to have Mobile Number Registered to Open FD?

Yes, it is mandatory to have your mobile number registered with your Canara Bank account. Not only for FD but it is recommended that you get your mobile number registered with your bank account to receive notifications of the transactions that are taking place in your bank account.

What is the Minimum Tenure of Fixed Deposit in Canara Bank?

The minimum tenure or the time period for which you can open a fixed deposit in Canara Bank is 7 days.

What is the Maximum Tenure of Fixed Deposit in Canara Bank?

The maximum tenure or time period for which you can open an FD in Canara Bank is 10 Years. You can not open an FD for period or tenure for more than 10 Years.

What is the Minimum or lowest Assured Fixed Deposit Interest Rate?

The minimum assured rate of interest you will get for the fixed deposit is 4.50% as of 1/01/2020. Even if you open an FD for 7 days you will get 4.50% as the rate of interest.

What is highest FD Rate for Canara Bank?

The highest FD rate that you can get in Canara Bank is 6.25% for regular FD and 6.75% for senior citizens.

Are there any Special Rates for Senior Citizens FD of Canara Bank?

Yes, the rate of interest which senior citizens get for a fixed deposit in Canara Bank is different when we compare that to the regular FD. The rate of interest for Senior Citizens is 5% to 6.75%

What is Minimum Canara Bank FD Rate for Senior Citizens?

The minimum interest rate which senior citizens get for their fixed deposit in Canara Bank is 5% p.a.

What is Highest FD Rate for Senior Citizens in Canara Bank?

The highest FD rates which senior citizens get in Canara Bank for the Fixed Deposit is 6.75% p.a.

What is the Tenure Range for Canara Bank Fixed Deposit?

The tenure of the FD in Canara Bank is 7 Days to 10 Years.

Is there any minimum amount that I have to give for Opening a Fixed Deposit with Canara Bank?

The minimum amount of Fixed Deposit in Canara Bank is Rs. 1,000.

Will TDS Certificate Issued for Canara Bank FD?

No, TDS Certificate will not be issued for the Fixed Deposit which you will be opening in Canara Bank.

Will I get TDS Credit from the Income Tax Department?

No, you will not get any kind of TDS Credit from the Income Tax Department.

Is Canara Bank FD Income Taxable?

Yes, as per the current Income tax rules whatever profit you earn out of the fixed deposit is taxable. This means you will have to pay the tax on the profits you earn out of the fixed deposit.

Can I Change the Tenure of my Current Canara Bank FD?

No, you can not change tenure or the time period of the fixed deposit which you have opened with the Canara Bank.

Can I deposit more money in my existing Fixed Deposit?

No, you can not change the amount of your existing FD in Canara Bank. You can not deposit more money into your Fixed Deposit once opened.

Is there any penalty for premature withdrawal?

Yes, you have to pay 1% of the total amount as penalty for premature withdrawal or breaking of the FD.

Can I Get Loan Against Fixed Deposit in Canara Bank?

Yes, you can get a loan up to 90% of your fixed deposit in Canara Bank.

How Can I Contact Canara Bank?

You can contact Canara Bank calling on their toll-free customer care number: 1800 1030.

Who is eligible for Opening an FD account in Canara Bank?

Individuals, Partnership Firms, Minors, Trusts, Blind persons, Illiterate persons, Joint Hindu families, Limited companies and partnership firms, Municipalities, panchayats, Charitable, religious, and educational institutions, Associations, societies, clubs, Sole proprietary concern can open an FD account in Canara Bank

Customer Care:

Customer Care: