Banking is all about the money, the money which we have earned, the money which someone has lent us and any miscellaneous income that we receive in our bank account. But what happens when we have got the money in our bank account? How can we withdraw the money? Well, there are many methods using which we can withdraw the money from our bank account. It can be using the withdrawal slip or the ATM Card. But one very important thing across which we come in the Banking industry is the fund’s transfer. But to do it you need to add beneficiary in your internet banking account.

I will be telling you all the steps which you need to follow to add beneficiary in IDFC First Bank’s Internet Banking. The procedure is quite simple and I am pretty sure you will get this done within 10 minutes if you have proper instruments with you. To add beneficiary you will require a desktop/laptop computer, a stable internet connection, and your account credentials. If you don’t want to use the desktop/laptop computer then you can use your smartphone as well. But for that, you will have to install the official mobile banking application of the IDFC First Bank.

One more thing which you should note and that is you should always use anti-virus software with internet security when you are using internet banking. If not you will be prone to be hacked. But what actually the term beneficiary means? Let me tell you about it.

What is Beneficiary in Internet Banking?

The beneficiary is the person to whom you want to send the money. Now, for example, you want to do a funds transfer to Mr. XYZ then he is the beneficiary here. You have to add his bank account details which constitutes the beneficiary in Internet Banking.

Before we proceed to the further part of this article let me tell you about the IDFC First Bank in brief. You should know about the bank where you hold your bank account and store all your hard-earned money.

About IDFC First Bank

| Type of the Bank | Private Bank |

| Traded As | BSE: 539437 NSE: IDFCFIRSTB |

| Industry | Banking and Financial Services |

| Predecessor | IDFC Bank and Capital First Limited |

| Founded | October 2015 |

| Head Quarters | Mumbai, Maharashtra |

How to Add Beneficiary in IDFC First Bank Internet Banking?

You can add beneficiary in IDFC First Bank using two methods. The first one is with the help of internet banking and the second one with the help of the mobile banking application. I will be explaining to you both these methods in this article you can use the one which is more convenient for you.

- Go to the official website of the IDFC First Bank.

- Click on Customer Login.

- Click on Personal and Business Banking.

- Enter your IDFC Bank Internet Banking Username and Password.

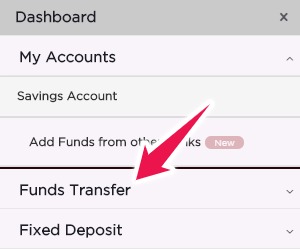

- Click on Funds Transfer.

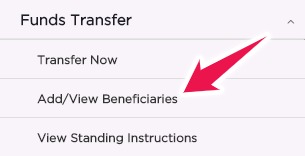

- Click on Add/View Beneficiaries.

- Click on Add new icon to add a beneficiary.

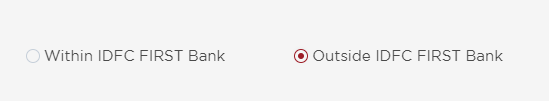

- Select if the beneficiary has the bank account with the IDFC First Bank or Outside the bank. (other banks)

- Enter the bank account number.

- Re-enter the bank account number.

- Enter the beneficiary name.

- Give a nickname to the beneficiary.

- Select the beneficiary’s bank name from the drop-down menu.

- Enter the IFSC Code of his or her bank.

- Select the type of the bank account the beneficiary holds. (Savings account or current account)

- Enter the payee limit and click on proceed.

If the beneficiary does not have the bank account in the IDFC First Bank then you should choose outside the IDFC First Bank option in step number 8.

- Open the mobile banking application of the IDFC First Bank.

- Enter your username and password or use your fingerprint to log in. (if enabled)

- Tap on the settings menu from the top left corner of the mobile banking application.

- Tap on Add or View Beneficiaries.

- Tap on +ADD button at the right corner of the screen.

- Choose between within or outside IDFC First Bank.

- Enter the beneficiary details like name, account number, IFSC Code, nickname and the payee limit.

- Tap on the Proceed button and follow the on-screen instructions.

It will take 30 to 50 minutes for your beneficiary addition to getting activated. After that, you can make funds transfer to your beneficiary.

Conclusion

So these are the two methods and the steps which you need to follow to add beneficiary in IDFC First Bank. I hope you are clear with all the details and the steps which are mentioned in this article. If you have any kind of doubts in your mind regarding the addition of beneficiary then you can comment down below. If you want to get assisted quickly right now then you can call the customer care of the bank.

How Can I Add Beneficiary in IDFC First Bank?

You can add the beneficiary details in the IDFC First Bank using their official website and also by using the official mobile banking application of the bank.

Are there any charges to add the beneficiary?

No, the bank will not charge you anything for adding the beneficiary in your internet banking account.

How to add an Inter-bank Beneficiary?

If you want to add an inter-bank beneficiary then you have to choose the type as Outside the IDFC First Bank when following the above-mentioned steps.

What is an Inter-bank Beneficiary?

When the person to whom you are sending the money or doing funds transfer has the bank account outside the IDFC First Bank is called an inter-bank beneficiary.

What is Intra-bank Beneficiary?

If the person to whom you want to send the money holds the bank account in the IDFC First Bank itself then it will be called as intra-bank beneficiary.

Can I Add Beneficiary without knowing my username and password?

No, you can not add the beneficiary details in your bank account if you don't know your username and password of the internet banking account.

Can I delete the beneficiary once added?

Yes, you can delete the beneficiary from your internet banking account anytime you want.

How much time it takes for beneficiary activation?

Your beneficiary will be activated within 30 to 40 minutes.

Can I transfer money before the beneficiary is activated by the bank?

No, you can not make funds transfer before the bank approves or activates the beneficiary details you have added.

What is Payee Limit?

Payee Limit is the maximum amount of money that you can send to any of the beneficiaries you have added to your internet banking account.

Customer Care:

Customer Care: