IDFC First Bank which was first called IDFC Bank is one of the fastest emerging banks which is operating in India. So far I personally feel that IDFC First Bank is the best bank to have a bank account with. I am pretty sure that even you are one of the bank account holders of this bank. That is because you are looking for information about the debit card of IDFC bank and it’s international usage. You can comment on your view about this bank. In this article of mine, I will tell you the steps which you need to follow to activate IDFC First Bank Debit Card for International Usage.

If you want to use your IDFC First Bank Debit card internationally then you need to make sure that the international usage of your card is switched on or activated. If it is not activated then you can not use your card to make transactions or purchases in the countries other than India.

Most of the ATM cards or Debit card which are issued by this bank are powered by VISA. I am not telling you that all the cards issued by this card are powered by VISA, I said most of the cards. Some of the account holders might even get the cards that are powered by other card operators like MasterCard and our very own Indian RuPay.

Before we proceed to the further part of this article and check out the steps to activate IDFC First Bank Debit Card for International Usage. It is quite important for us to understand what actually is the meaning of International Usage. So let us first understand it.

What is International Usage in Debit Cards?

There are some debit cards that can be used only in our country which are termed as domestic cards. And there are some cards which can be used anywhere around the world, those cards are termed as international debit cards.

I would like to tell you one thing and that is if you have a domestic only debit card with you then you can not activate international usage for that card.

It is mandatory that you should have a card that supports international transactions.

When you use your debit card to make transactions on international e-commerce websites, make purchases in other countries, and withdraw money in other countries then that is called international usage in debit cards.

How to Check if Your Debit Card Supports International Usage?

As I already that not all the cards support international transactions or usage. You can check if your cards support international usage by reading the text on your card.

If your card supports it then you can find “INTERNATIONAL DEBIT CARD” mentioned on your card. It is quite easy to make out if any card is a domestic-only card or international card.

Not all the cards will be having this term mentioned on them. So the most simple explanation about this is if your card is powered by VISA, MasterCard, or Maestro, American Express, Union Pay then it will support international transactions.

What about Indian RuPay Cards?

Now, we know the cards which will support international transactions. But we did not see our very own RuPay in the list but why?

That is because currently, not all the banks issue the RuPay powered cards that work internationally.

But this does not mean that RuPay is not functional outside India. There are two global variants of RuPay cards and they are RuPay Global Classic Debit Card and RuPay Global Platinum Debit Card.

Both these variants are accepted with not just Discover, Diners Club, and Pulse, but also at over 40.1 million POS locations and over 1.88 million ATM locations in 185 countries and territories worldwide.

Soon we will be getting the international debit cards that are powered by very own RuPay. NPCI is making great efforts to make RuPay functional in all the countries across the world.

How much will be Debit Card’s International Usage Fees?

You should know that you will have to pay some extra money for every international transaction that you make with your debit card. Usually, the international usage fees or transaction fees will be 2% to 5% and there are some banks which charge you more than 5%.

Here it is very important that 2% to 5% of your total transaction amount will be charged as your international transaction fees.

How You Can Be Charged for your International Usage or Transaction?

There are most 3 ways in which you can be charged for every transaction you make with your debit card abroad. I have mentioned those three below.

- The bank which owns the ATM machine might charge you.

- Your bank might charge you for using the card out of the home network of ATM machines.

- You might be charged for the currency conversion.

However, if you don’t want to pay the transaction fees then you should opt for a forex card that won’t be having transaction fees. There are many companies that offer forex cards with no extra charges.

How to Activate IDFC First Bank Debit Card for International Usage?

Now we know quite many things about international transactions and the debit cards which can support international transactions. So its now time to check out the steps which you need to follow to activate IDFC First Bank debit card for international usage.

There are 3 methods that you can follow to activate IDFC First Bank debit card for international usage or transactions.

- By using internet banking of the bank.

- By using the mobile banking application.

- And by calling the customer care.

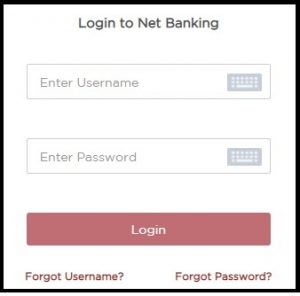

- Go to the official website of the IDFC First Bank.

- Click on Customer Login.

- Click on Personal and Business Banking.

- Enter your IDFC Bank Internet Banking Username.

- Enter your password and click on Login button.

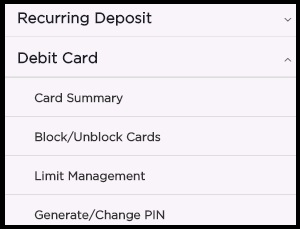

- Click on Debit Card.

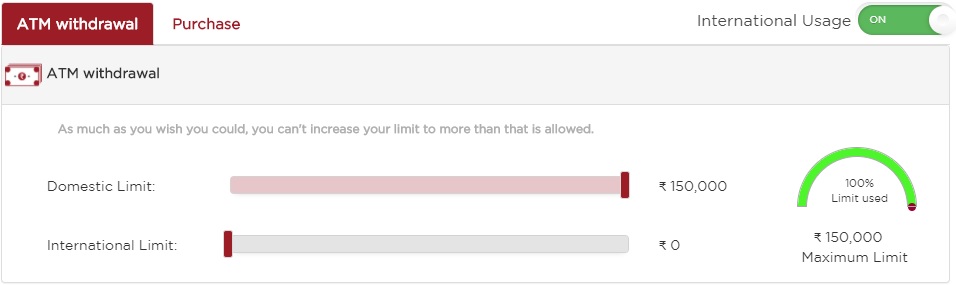

- Click on Limit Management.

- Select the ATM card whose international usage you want to activate.

- Turn on the International Usage Button and you are done.

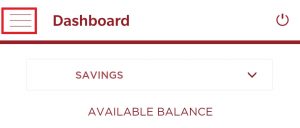

- Open the mobile banking application of IDFC First Bank.

- Enter your username and password.

- Click on Settings on the dashboard.

- Click on Limit management.

- Select the Debit card.

- Turn on the International Usage Button.

When you try to activate IDFC First Bank Debit Card for International usage, you will be receiving an OTP on your registered mobile number. You have to enter that OTP both in the case of internet banking and mobile banking.

- Call the customer care of IDFC First Bank on their toll-free number: 1800 10 888.

- Select the IVR option to talk to the customer care executive.

- Tell the customer care executive that you want to activate international usage of your debit card.

- Confirm the details like your debit card number.

- The customer care executive will enable or activate it for you.

When you call the customer care of the bank they will ask you a few details for verification purposes. Usually, they ask your bank account number, your mother’s name, etc. you have to answer these questions correctly to proceed with the process to activate IDFC First Bank debit card for international usage.

Tip: Do you know that you can set domestic as well as the international limit of your IDFC First Bank Debit Card? Read more about the limits in this linked article.

Conclusion

So these are the 3 methods that you can follow to activate IDFC First Bank debit card for international usage. Here ATM Card and Debit Card are one and the same. Don’t be confused between the ATM card and Debit Card. I hope you are clear with all the details which are mentioned in this article. If you have any doubts in your mind then you can comment down below.

How do I activate my IDFC first bank debit card?

You can activate your IDFC First Bank debit card with the help of internet banking as well as the mobile banking application. To activate the card click on Debit Card in the internet banking interface.

How can I use my Debit Card in ATM first time?

There is no special way to use your debit card for the first time. Once you activate your IDFC Bank ATM card you will be able to use it in a normal way.

Is there any insurance for ATM card holder?

Yes, there is some personal insurance cover for the people who have a debit card of IDFC First Bank. You can contact the bank on their toll-free number to know more about the Insurance cover you get with the help of your ATM Card.

Can You Use a Debit Card at an ATM?

Yes, you can use your debit card at any of the ATM machines. And you should note one thing and that is here debit card and ATM card are one and the same.

Can I use my debit card as a credit card?

No, you can not use your IDFC First Bank debit card as a credit card.

Can you withdraw money from an ATM without a debit card?

Yes, you can withdraw money from your account without a debit card. But only if your bank supports to do it. For example, SBI has a feature by name YONO Cash which allows the user to withdraw money without having a debit card.

What is the Purpose of Debit Card?

The purpose of debit card is to allow you to withdraw money from your bank account 24x7 from any ATM Machine. Other than this the debit card has many purposes like using it for online shopping, making your bill payments at POS (point of sale) and more.

Can you take money out of any ATM?

Yes, you can withdraw or take out money from any of the ATM Machine with your debit card or ATM Card. Provided you have sufficient balance in your bank account and you know the correct PIN of your card.

What happens when you use a debit card?

When you use your debit card for any transaction it can be a cash withdrawal or online payment. The same amount of money will be deducted from your bank account and will be paid to the merchant from whom you are getting the products and services.

What happens if I use my debit card as a credit card?

Nothing happens when you use your debit card as a credit card. Because you can never use your debit card as a credit card it is just not possible to do it.

Customer Care:

Customer Care: