To check Federal Bank KYC Status, visit the KYC Status Check Page on the bank’s official website. Enter your bank account number and click on the Check Button. The KYC status will be displayed to you on your screen.

KYC is really important these days. If your bank account is not KYC proof then you will face difficulties in using your account. And if you are planning to open a new bank account with any of the banks which are operating in India. Then you have to provide the full set of KYC documents to the bank of your choice.

If you don’t have KYC documents then it is nearly impossible to open a bank account in India. Today I will tell you how you can check KYC status in Federal Bank. This article is for those people who want to verify if the bank account they have with Federal Bank is KYC proof or no.

Checking the Federal Bank KYC Status is really simple. The bank has provided the option to do it online. I have already explained to you how you can check it using its official website. The same is explained in detail below. But before that let me tell you a few things about this bank.

About Federal Bank

| Type of Bank | Private Bank |

| Headquarters | Aluva, Kochi, Kerala, India |

| Founded | 23 April 1931 |

Steps to Check Federal Bank KYC Status

There is no requirement to go to the home branch or call the customer care of the bank to check your KYC status. This can be easily checked from the official website of the Federal Bank. The detailed instructions can be read below.

- Open the KYC Notice page on the official website of the Federal Bank.

- Click on the “Know KYC Status” button.

- Enter your bank account number and click on Check.

- The KYC Status of your bank account will be displayed to you on your device’s screen.

What to Do if KYC is Not Done?

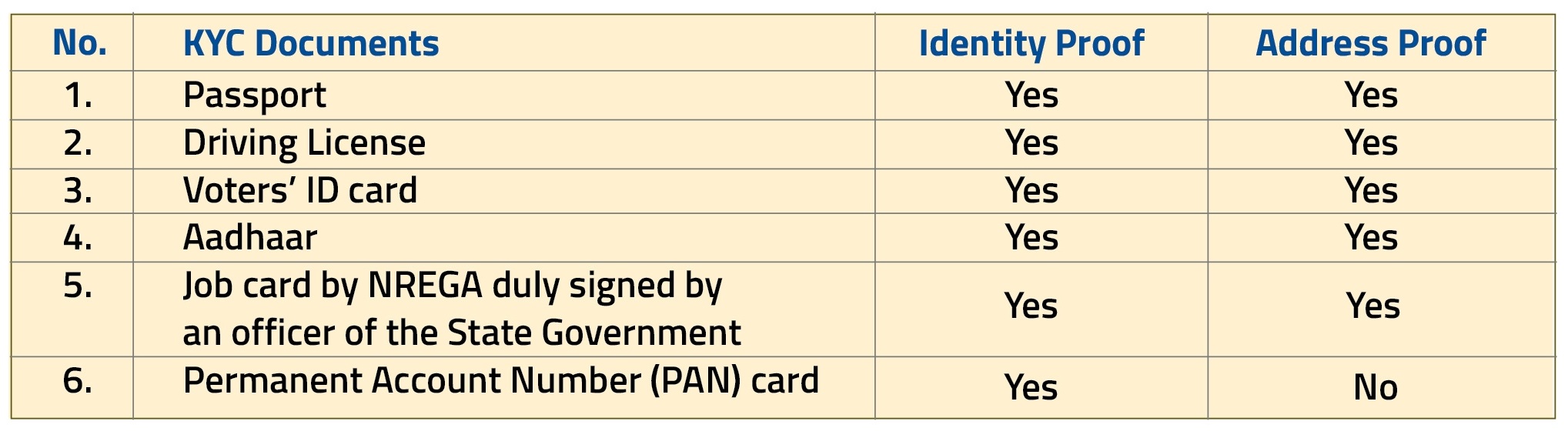

KYC is an acronym for Know your Customer. If you find that your bank account is not KYC compliant then you can update your KYC online as well. Basically you have to submit some documents which can help the bank verify your identity and address.

The documents that can be submitted to verify identity proof are listed below.

- Passport.

- Driving License.

- Voter ID Card.

- Aadhaar Card.

- Job Card by NREGA duly signed by an Officer of State Government.

- PAN Card.

The documents that can be submitted to verify address proof are listed below.

- Passport.

- Driving License.

- Voter ID Card.

- Aadhaar Card.

- Job Card by NREGA duly signed by an Officer of State Government.

Customer Care:

Customer Care: