Online banking or internet banking is not a new thing we have been using it for a long time now. With the help of Internet banking, there are a lot of things that can be done. This article will give you a step-by-step process to get your SBM Bank account statement.

Prequsities: You need a device to access the official website of SBM Bank along with the login credentials of your Internet banking account.

- Visit the official website of SBM Bank.

- Click on “Login”, and enter your login credentials to access the Internet banking services.

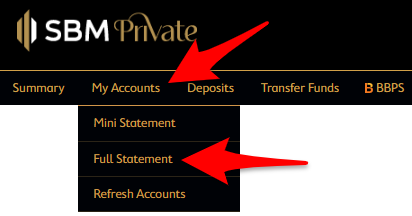

- Once you log in, click “My Accounts” and select “Full Account Statement” from the top menu.

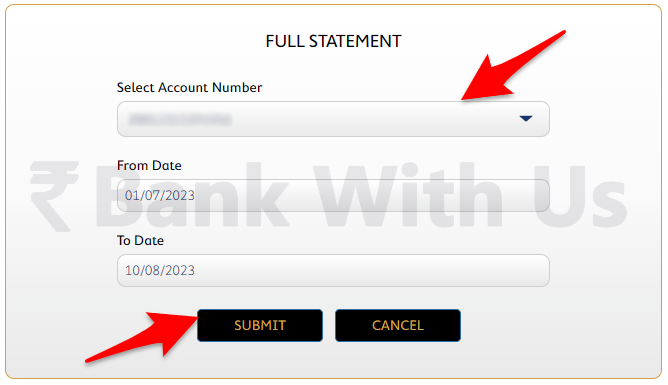

- Select your bank account number whose statement you wish to get using the drop-down menu.

- Now select the date range of your bank account statement using the calendar option and click on the “Submit” button.

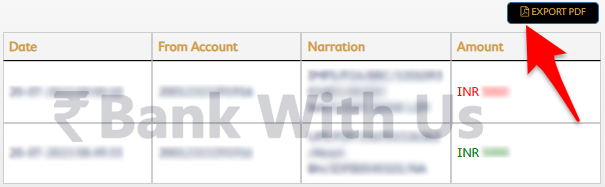

- All the transactions you have done during the selected date range will be displayed to you.

- If you want to download the statement then click on the “Export PDF” button.

Opening the Downloaded Statement: Your downloaded SBM Bank account statement will be password protected. The password to open the file will be the First four characters of your name in UPPER Case followed by your Date of birth in DD/MM format.

This is not the only method to get your SBM Bank account statement. If you are not comfortable using Internet banking services. Then you can visit your home branch of SBM Bank and ask the bank officials for your account statement.

While you visit the branch of the bank ensure to carry any one of your valid identity proof documents. The online account statement is free of cost. But if you are following the offline method then the bank may charge you.