These days almost all the banks in India offer their account holders services of Internet banking and mobile banking. With these services, you can do a lot of things without having to visit your home branch. Things like transferring money from your account to another bank account. But to do that you will have to add the receiver’s bank account as a beneficiary in your account. This article will guide you with the steps to follow to add beneficiary in SBM Bank.

There are mainly two types of beneficiary accounts when it comes to SBM Bank. And they are the SBM Bank account and other bank account.

Let us understand which type to be used when by you.

SBM Bank Account: You can add this type of beneficiary if the person to whom you wish to transfer money holds an account with SBM Bank account just like you.

Other Bank Account: You can use this type when the receiver does not hold an account with SBM Bank but with any other bank in India. For example, he or she may be holding an account with the State Bank of India or IDFC FIRST Bank.

- Visit the official website of SBM Bank and login into your Internet banking account.

- Click on the “Transfer Funds” → “Add Beneficiary”.

- Now choose between an SBM Bank account and other bank account.

- Enter the beneficiary account details like Name, account number, IFSC Code, and click on the “Continue” button.

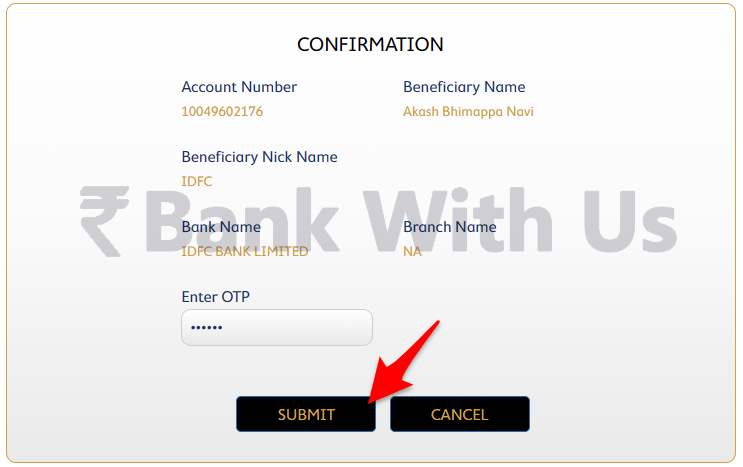

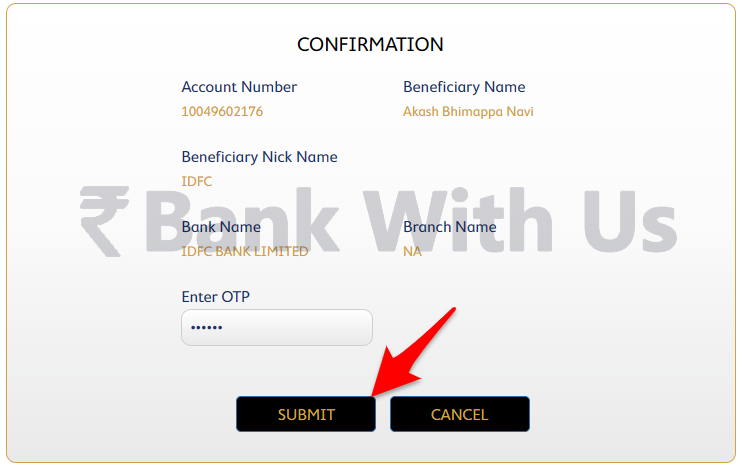

- SBM Bank will send you an OTP on your registered mobile number for confirmation.

- Enter the OTP on the confirmation page and click on the “Submit” button.

Conclusion

This is how you can add beneficiaries to your SBM Bank account using Internet banking access. The beneficiary account you have added will be available for the funds transfer within 30 minutes with the standard limits. If you need more help then you can contact the customer care of the bank.